Kennewick Mortgage Lenders

To get a great mortgage rate, look for a lender who is transparent about their fees. This helps home buyers get the most effective loans for their specific situations, not the biggest loans.

* $800,000 | 30-Yr-fixed | Credit Score 800+ | 25% Down Payment

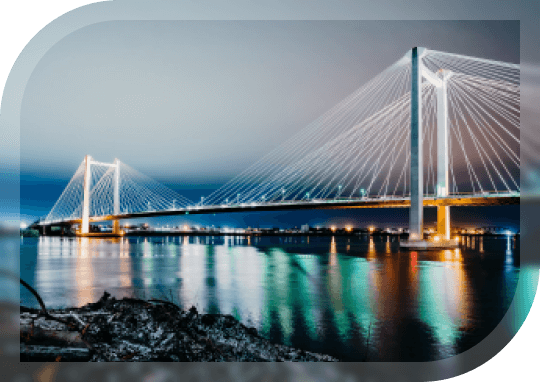

Kennewick, WA, is a thriving city in the heart of the Tri-Cities, known for its sunny climate, scenic river views, and growing economy. Whether you’re a first-time homebuyer, upgrading, or looking to invest in property, Sammamish Mortgage offers personalized solutions to help you navigate Kennewick’s dynamic real estate market.

Understanding the factors that affect mortgage rates can help you secure the best deal:

Our mortgage advisors will guide you through these factors to find the ideal rate for your situation.

With over 30 years of experience, our team is dedicated to providing personalized mortgage advice and competitive rates. We prioritize transparency, customer service, and efficiency to help you achieve your homeownership goals.

Kennewick offers a diverse range of housing options, from new suburban developments to charming riverfront properties. The city’s affordable living, excellent schools, and vibrant community make it a desirable place to call home.

We provide a wide selection of loan options to meet your needs:

To get a great mortgage rate, look for a lender who is transparent about their fees. This helps home buyers get the most effective loans for their specific situations, not the biggest loans.

There are many different types of real estate loans available for Kennewick borrowers.

A 30-year fixed rate loan is one of the most popular types of mortgages, since it lets you spread out the cost of buying a home in Washington for a reasonable monthly mortgage payment.

VA loans are designed for veterans, service members, and surviving military spouses. Qualifying borrowers can get a home loan with no down payment.

FHA loans are designed for low income or first-time home buyers who may not have perfect credit or a big down payment. You can achieve home ownership sooner than you think.

Jumbo loans can help qualify you to buy a home in a more expensive part of the country, even if the price of the home is higher than conventional loan limits.

Whether you’re buying a home or ready to refinance, our professionals can help.

{hours_open} - {hours_closed} Pacific

No Obligation and transparency 24/7. Instantly compare live rates and costs from our network of lenders across the country. Real-time accurate rates and closing costs for a variety of loan programs custom to your specific situation.