No Obligation and transparency 24/7. Instantly compare live rates and costs from our network of lenders across the country. Real-time accurate rates and closing costs for a variety of loan programs custom to your specific situation.

What credit score is needed to buy a house in Washington State? That depends. Mortgage lenders have their own standards, and different loan programs have different credit requirements. We will go over credit score requirements to buy a Washington home in this article.

When you buy a home and apply for a mortgage to finance it, you’ll need to first apply and get approved for a home loan. There are many things that lenders assess before they grant mortgage approval, and credit scores are one of them. So, what credit score is needed to get approved?

When you apply for a home loan, the mortgage lender will review your finances to see if you’re capable of repaying the debt. They’ll consider your monthly income and assets, your recurring debts, and other aspects of your financial situation.

They’ll also look at your credit score, and this can partly determine whether or not you’re able to buy a home in Washington State.

Credit scores are three-digit numbers that give mortgage companies insight into how you’ve borrowed and repaid money in the past.

For example, a person who has always repaid his or her debts on time will likely have a high score. On the other hand, a person with a pattern of late payments and delinquencies will probably have a comparatively lower score.

Consumers in Washington State are doing quite well in terms of creditworthiness. Right now, the average credit score among residents is 731, which is higher than the nationwide average of 711, according to Experian.

A good credit score will help you qualify for a mortgage loan to buy a home. An excellent score will also help you qualify for a low mortgage rate, which could save you money over time.

Bad credit tends to have the opposite effect. It could make it harder for you to get a mortgage loan and may also bring a higher interest rate.

The FICO credit score — the one that is most commonly used by mortgage lenders and other financial companies — ranges from 300 to 850. Higher is better.

So, what credit score is needed to buy a home in Washington State? Generally speaking, mortgage lenders today prefer to see a score of 600 or higher. But this number is not set in stone.

The truth is, there is no single cutoff point for credit scores across the industry. It can vary from one mortgage company to the next.

Lenders in Washington State generally like to see credit scores of at least 620. Any lower than that may put you at risk of being denied a mortgage. Ideally, your credit score should be even higher than this.

Based on the figures mentioned above, the average Washongton consumer may be in a good position to get approved for a mortgage with an average score of 731.

That said, you might still be able to qualify for an FHA loan with a credit score of less than 620. More specifically, FHA loans can accept credit scores as low as 580, and in some cases, 500. The exact score you can qualify with will depend on other factors, as well as the lender you work with.

When it comes to your credit score and home loan, the most important thing to remember is that the higher your credit score, the lower your mortgage interest rate will probably be, and vice versa.

The minimum credit score you need to get approved for a mortgage in Washington State will depend on a few things, including the type of home loan you’re applying for. Generally speaking, here are the minimums needed for the following mortgage types:

Credit is just one facet of the mortgage qualification process. Lenders look at other factors as well, including income stability and cash reserves.

The important thing is to avoid making assumptions about your ability to qualify for a home loan. The only way to find out if you’re qualified for mortgage financing is to speak to a lender. (Feel free to contact us, if you’d like.)

Mortgage companies tend to look at the “big picture” when reviewing loan applicants. Credit scores are just one part of that picture.

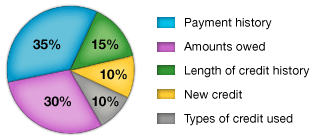

There are 5 main factors that influence your credit score according to the chart below:

As you can see from the pie chart, your “payment history” accounts for 35% of your credit score under the FICO scoring model. That’s more than any other single factor. As a result, late and missed payments can seriously lower your score.

So, what can you do if you find out your credit score is too low to buy a home in Washington State? The good news is you’re not powerless. There are certain steps you can take to improve your credit score by taking the following steps:

The first, and possibly most important, step is to make sure you pay all of your bills on time going forward. Pay particular attention to the things that show up on your credit reports, like personal loans, credit cards, etc.

So pay those bills on time. Setting up payment reminders and enrolling in automatic bill payments are two ways to keep up with your bills.

According to myFICO.com (which is owned by the company that actually created the FICO scoring system), reducing the amount of debt you owe might also improve your score. Having too much debt relative to income can lower a person’s score.

Also, refrain from applying for too many loans within a short window of time. Every time a lender conducts a “hard inquiry” on your credit report to find out what your credit health is like, it can pull down your credit score, albeit temporarily.

You also want to minimize your credit utilization ratio, which you can do by making sure that you don’t spend any more than 30% of your credit card limit.

And if you have old credit accounts that are in good standing, don’t close them out, even if you don’t use them. These might be having a positive impact on your credit score.

Not only does your credit score affect your chances of getting approved for a mortgage, but it can also influence the mortgage interest rate you are offered. As mentioned, a higher credit score can lower your rate, and vice versa. But by how much?

A lower credit score can save you thousands of dollars over the life of your loan. You’ll want to compare how different credit scores affect your mortgage rate.

Each lender will have a different formula to establish mortgage interest rates. But just a small difference on your credit score can make a difference.

For example, let’s say your lender is willing to offer you a rate of 4.0% based on your current credit score. On a $300,000 mortgage for a 30-year term, your monthly mortgage payments come to $1,426.

But if you bump up your credit score by just a few points, your lender may be willing to reduce your rate to 3.0%. Using the same parameters, that would reduce your monthly payments to $1,261, which is $165 less each month.

As you can see, taking steps to boost your credit score to bring your interest rate down can help you realize significant savings.

Are you planning to buy a home in Washington State and need a mortgage loan to make it happen? We can help. Sammamish Mortgage has been serving borrowers in Washington, Oregon, Colorado, and Idaho since 1992. Our loan experts can review your credit score, income, and other financial factors to determine if you’re a good candidate for a home loan and can review all our mortgage programs. We can even pre-approve you before you start shopping for a home, to make you a more competitive home buyer.

Whether you’re buying a home or ready to refinance, our professionals can help.

{hours_open} - {hours_closed} Pacific

No Obligation and transparency 24/7. Instantly compare live rates and costs from our network of lenders across the country. Real-time accurate rates and closing costs for a variety of loan programs custom to your specific situation.